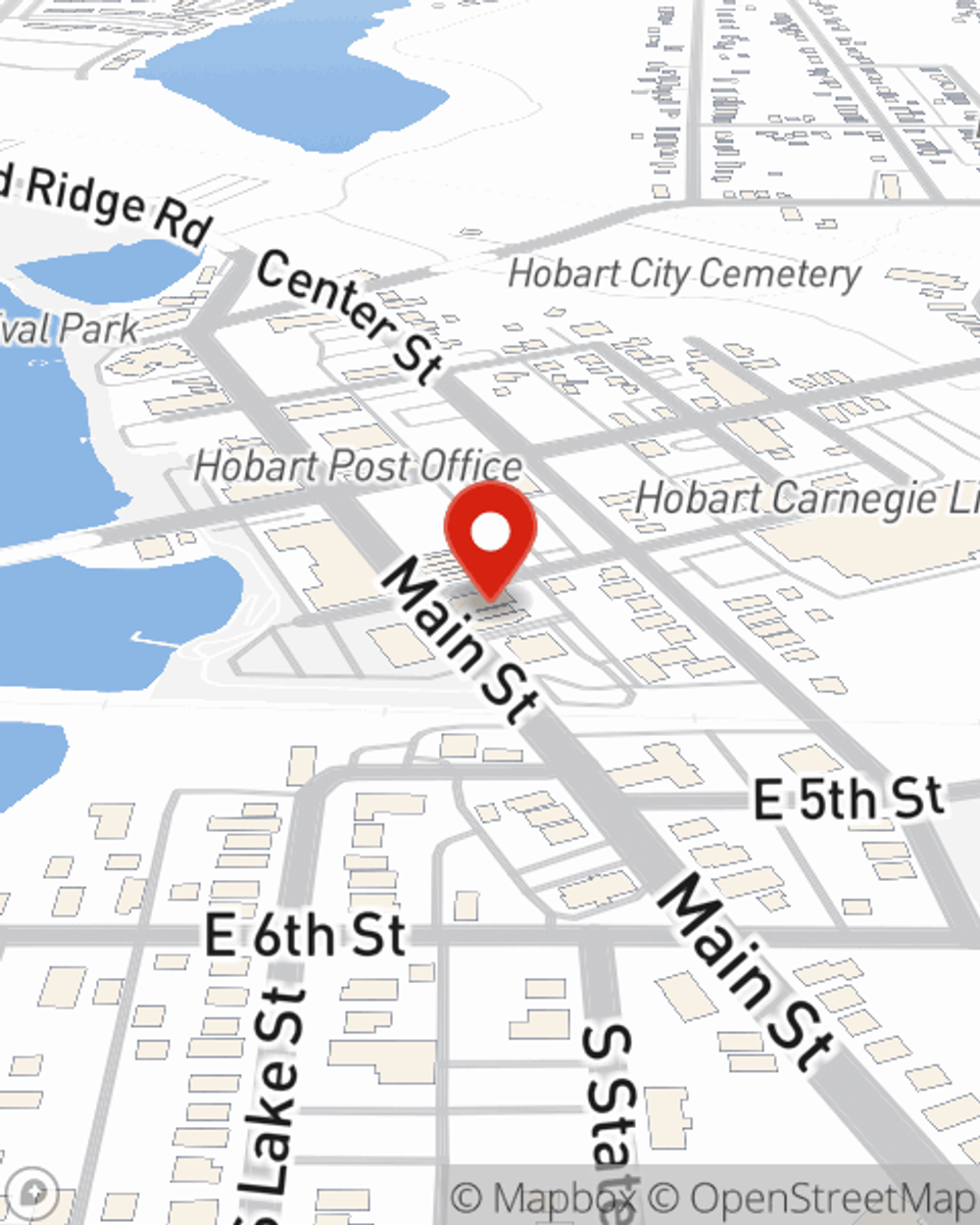

Business Insurance in and around Hobart

Get your Hobart business covered, right here!

No funny business here

Your Search For Reliable Small Business Insurance Ends Now.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent John Yelkich, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you customize a policy that's right for your needs.

Get your Hobart business covered, right here!

No funny business here

Cover Your Business Assets

For your small business, whether it's a music school, a pizza parlor, a window treatment store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like extra expense, computers, and buildings you own.

Get in touch with the wonderful team at agent John Yelkich's office to identify the options that may be right for you and your small business.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

John Yelkich

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.